Opting out of an audit

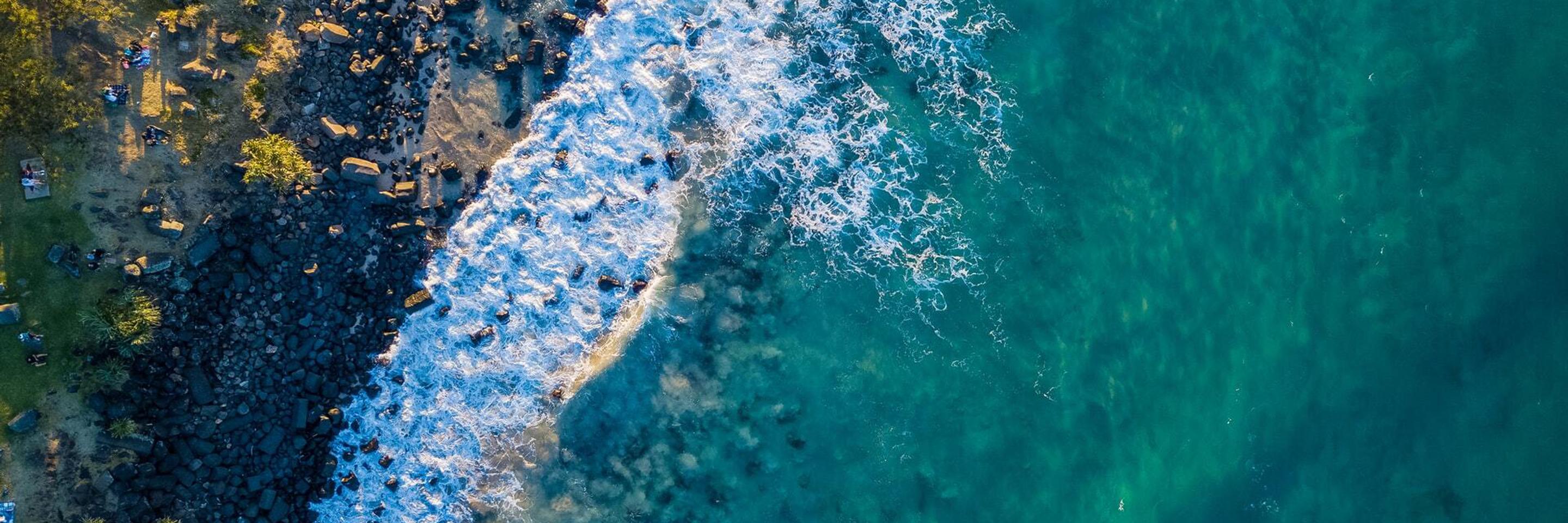

We’re everywhere you need us

Around the world or around the corner, Baker Tilly is ready to help.

We’re everywhere you need us

Around the world or around the corner, Baker Tilly is ready to help.

Before opting out of an audit, we recommend that management carefully considers opting out and assesses who actually uses the accounts.

There are many good reasons to have an audit, even though there is no requirement, as an audit gives the annual accounts value and trust for users.

Baker Tilly recommends that management and shareholders in this respect consider what the stakeholder’s position is to opt-out:

- Are there any shareholders who are not involved in daily operations?

- How will the bank or the company’s creditors stand?

- Are there external board members who may be held liable?

- Will the company use the audited annual accounts, for example, for a future sale or new borrowing options with the bank or from external investors?

- Will any new business partners use the annual accounts, for example, for credit approval?

If you are considering an extended review, we recommend that you contact Baker Tilly to discuss it in more detail.

Contact